If you’re building a startup today, chances are your customers, contractors, or suppliers are spread across multiple countries. That means one thing: handling international money is unavoidable.

So which platform should you trust with your business’s global payments and expenses? That’s where the debate of Revolut vs Wise vs Skrill for startups comes in.

Each promises low fees, multi-currency accounts, and slick apps. But they’re not all the same — and the wrong choice could cost your startup serious money and headaches.

In this in-depth guide from Adam Tech Guide, we’ll break down everything you need to know about these fintech giants, so you can pick the best partner for your growing business.

💡 Why Startups Need Fintech Tools

Gone are the days when startups could just open a local business checking account and call it a day. Today, even tiny teams hire freelancers abroad, pay suppliers in China or Poland, and invoice clients in USD, EUR, or GBP.

Traditional banks simply aren’t built for this. High wire fees, slow transfers, poor multi-currency options, and endless paperwork make them a poor fit.

That’s why tools like Revolut, Wise, and Skrill have become the new normal for startups. They’re fast, online-first, and far more transparent on international costs.

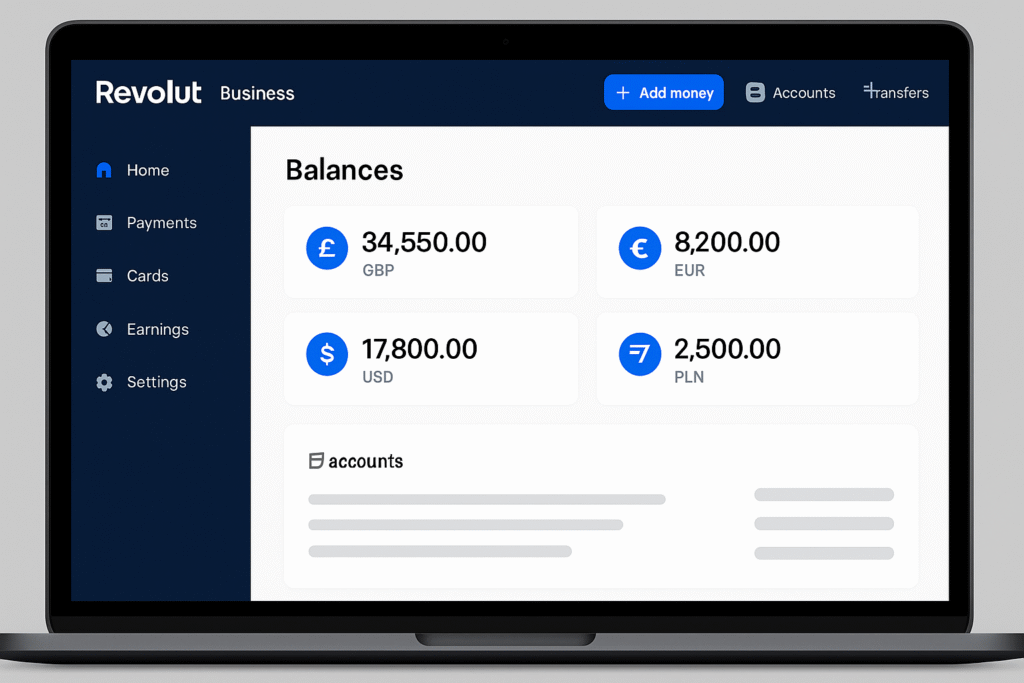

🏦 Revolut: The Modern Business Super-App

Revo started as a simple travel card but has grown into what some call a “financial super-app.”

🌐 What makes Revolut stand out

- Multi-currency accounts: Hold, send, and receive 25+ currencies.

- Expense cards: Give team members prepaid cards, track spending in real-time.

- Analytics & budgeting: See exactly where money goes each month.

- Perks: Discounts on tools startups already use (like Slack, Notion, Google Ads).

🏦 Revolut Business Accounts

With Revo Business, you get dedicated IBAN accounts for multiple currencies, easy invoice generation, and even payroll tools.

💸 Wise: Simple, Transparent Global Transfers

Formerly TransferWise, Wise has become synonymous with fair, transparent international transfers.

🔍 Why startups love Wise

Real exchange rates: You get the same mid-market rate you see on Google.

Multi-currency balances: Hold 50+ currencies in one account.

Local receiving accounts: Accept USD, GBP, EUR, AUD, NZD like a local company.

It’s especially loved by startups that bill customers in multiple countries or pay freelancers in local currencies — avoiding hefty conversion fees.

💰 Skrill: Flexible Payments & Digital Wallets

Skrill started as a digital wallet similar to PayPal but evolved to support B2B payments, prepaid cards, and mass payouts.

🔑 What Skrill offers startups

- Quick international payments: Popular with affiliate networks & e-commerce.

- Prepaid Mastercard: Spend funds instantly worldwide.

- Integrations: Many payment platforms (especially gaming & affiliate verticals) prefer Skrill.

It’s often used by startups who pay contractors in countries where other options are limited, or who work in industries that Skrill uniquely serves.

⚖️ Feature-by-Feature Comparison

Let’s put Revolut vs Wise vs Skrill side by side to see how they truly differ.

| Feature | Revo | Wise | Skrill |

|---|---|---|---|

| Multi-currency holding | ✅ 25+ currencies | ✅ 50+ currencies | ⚠ Mostly EUR/USD |

| Local receiving accounts | ⚠ Only for some currencies | ✅ Full local accounts in 10+ currencies | ⚠ Limited |

| Team expense cards | ✅ Yes | ⚠ No, personal focus | ✅ Prepaid for business |

| Real mid-market FX rate | ⚠ Small markup | ✅ Always transparent | ⚠ Often higher fees |

| Bill pay & invoicing | ✅ Built-in | ✅ Manual | ⚠ Limited invoicing |

| Cashback/perks | ✅ Discounts & savings | ⚠ None | ⚠ Few |

🔐 Security & Trust

All three platforms take security seriously:

- Revo is authorized by the FCA in the UK and holds client funds in segregated accounts.

- Wise also regulated by the FCA and other global regulators, famous for its transparency reports.

- Skrill is part of Paysafe Group, licensed across Europe and beyond.

Each uses 2FA, encryption, and fraud monitoring. So for general startup payments, they’re all robust.

💸 Costs & Hidden Fees

🏦 Revo fees

- Free for basic accounts, then from $9.99/month for startups needing multiple users or priority support.

- Currency conversion has a small markup outside weekdays or above your monthly quota.

💵 Wise fees

- No monthly fees. Pay a flat small % on each transfer (often <1%).

- Always shows the mid-market rate, so you know exactly what you’ll pay.

💳 Skrill fees

- Sending money: often ~1.45% to other Skrill users.

- Currency conversions: usually higher markup than Wise.

Prepaid card: annual fee + ATM withdrawal fees.

🚀 Who Should Choose Which?

Choosing Revolut vs Wise vs Skrill for startups depends on your business model.

✅ Pick Revo if:

You want a slick all-in-one finance hub with expense cards, employee controls, and you’ll frequently pay in multiple currencies.

✅ Pick Wise if:

You do lots of cross-border payments and want to hold many currencies with near-perfect rates — especially paying international freelancers or agencies.

✅ Pick Skrill if:

You’re in industries like affiliate marketing, gaming, or need mass payouts in countries other services skip.

💡 Pro Tip: Many savvy startups use Revolut for everyday expenses, Wise for international invoices, and keep Skrill for niche payouts. You don’t have to pick just one.

❓ FAQs

🔹 Is Revolut better for everyday expenses?

Yes, especially with expense cards and perks that help manage teams. But Wise is often better for paying contractors abroad.

🔹 Can I use Wise for team spending?

Not directly — Wise doesn’t yet have business debit cards for multiple employees, just the main account holder.

🔹 How about Skrill’s prepaid card?

It’s handy if you want to instantly spend your Skrill balance. Especially popular in affiliate or high-traffic payout environments.

📝 Conclusion

Managing money across borders shouldn’t be a painful ordeal. Thanks to platforms like Revolut, Wise, and Skrill, startups can pay teams, receive client funds, and spend globally with ease.

There’s no single winner — it depends on your exact needs. But by understanding how Revolut vs Wise vs Skrill stack up, you’ll set your startup up for smoother operations (and far fewer banking headaches).

🔗 More Startup Guides on Adam Tech Guide

Looking to build a complete toolkit for your startup? We’ve covered everything from funding to crypto payments. Here are some other posts you’ll find helpful:

🚀 Startup Funding 101: Bootstrapping vs. Venture Capital Explained

Learn whether you should self-fund or chase investors — and how each path shapes your business.🏗 Best Tools for Lean Startups: Asana, Trello, Monday.com & More

A deep dive into the project management software that keeps your growing team on track.💳 Complete Guide to Stripe vs PayPal for Startups

Find out which payment processor suits your business model (and wallet) best.🌍 Why Founders Use Revolut, Wise & Skrill to Manage Global Cash

(Yes, we’ve zoomed out here too — if you want a broader overview beyond just these three.)🪙 Crypto.com Review: All-in-One Crypto Platform for Businesses & Individuals

Thinking of accepting crypto payments or just want to earn cashback? This guide has you covered.