Cryptocurrency isn’t just disrupting finance — it’s transforming how we protect and own value. Whether you’re casually trading Bitcoin or holding Ethereum long-term, one decision stands above the rest: how you store your digital assets.

So what’s the right choice for you — a hot wallet or a cold wallet? This guide breaks down the differences, benefits, drawbacks, and gives you a clear path to securing your investment.

📚 Table of Contents

🔍 What is a Crypto Wallet?

A crypto wallet is essentially a tool that manages the private keys controlling your coins on the blockchain. Think of it as a secure vault: whoever holds the keys controls the assets.

Unlike a leather wallet in your pocket, this is about safeguarding credentials that prove ownership of your funds — making your choice critical for anyone serious about digital currencies.

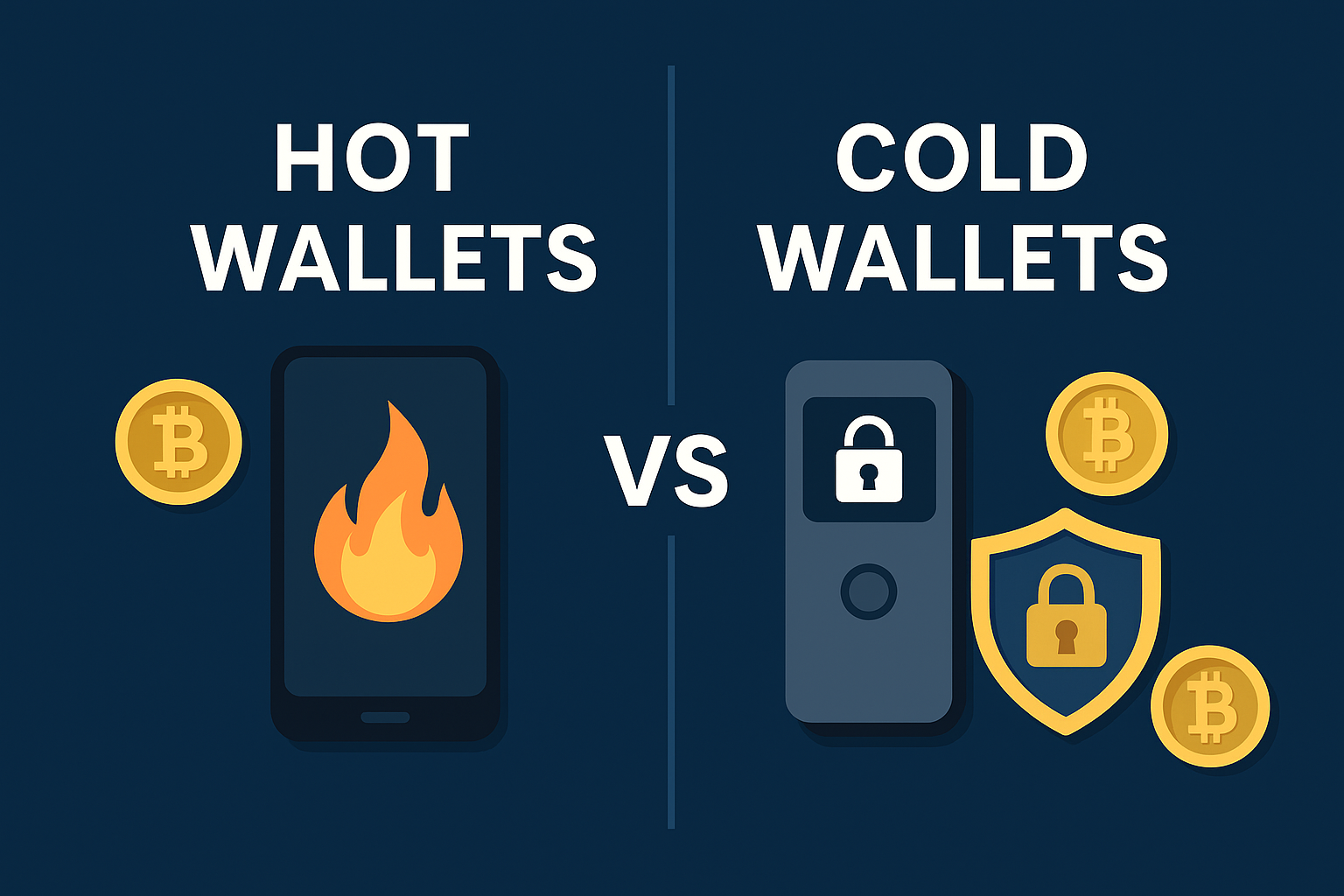

🌐 Understanding Hot Wallets

Hot wallets are programs or apps connected to the internet. They’re popular among people who actively buy, sell, or use their digital coins.

✅ Pros and Cons

Why use them?

Incredibly convenient for daily transactions and crypto trading.

Quick to set up and usually free.

What’s the risk?

Since they’re online, they’re exposed to hacking, phishing, or malware.

Best to keep only a small amount here for spending or fast trades.

❄️ Exploring Cold Wallets

Cold wallets, by contrast, keep your private keys completely offline. They’re the gold standard for security, ideal for storing substantial assets long-term.

🗝️ Examples of Cold Wallets

Hardware devices like Ledger Nano or Trezor

Paper wallets, which print out your keys

Dedicated offline computers for signing transactions

✅ Cold Wallet Pros and Cons

Why choose this route?

Nearly immune to online attacks.

Gives peace of mind for large holdings.

What’s the catch?

Less convenient for immediate transactions.

Hardware solutions require an upfront investment and careful backup of recovery phrases.

⚔️ Main Differences at a Glance

🔐 Security

Offline storage is by far the safest way to protect your assets. Keeping private keys away from any network drastically reduces hacking risks.

Meanwhile, online wallets are only as secure as your passwords, two-factor settings, and browsing habits.

🚀 Convenience

If you trade often, online solutions make it simple. You can move coins in seconds. Cold options require extra steps, like plugging in a device or importing keys.

💰 Costs & Management

Most hot wallets are free apps. Cold devices cost anywhere from $50 to $200. They also demand secure backup of recovery words to prevent loss from theft, damage, or simple misplacement.

🧭 How to Choose the Right Storage Method

The smartest strategy? Combine both.

Use a hot wallet for everyday spending or quick trades.

Store the majority of your portfolio offline, where it’s shielded from common online threats.

This approach balances security and convenience, so you can participate in crypto trading without putting your entire investment at risk.

💡 Internal tip: Not quite sure how Bitcoin even works yet? Check out our complete beginner’s guide to Bitcoin to start with the basics.

🔗 Affiliate Disclosure

Some links on this page are referral links. If you sign up or make a purchase through them, we may earn a small commission — at no extra cost to you. Thanks for supporting Adam Tech Guide!

🚀 Final Thoughts

How you store your coins is just as important as what you choose to buy. Whether you pick an app for daily use or a secure device for large sums, always remember:

✅ Back up your recovery phrases.

✅ Enable two-factor authentication.

✅ Stay vigilant against phishing scams.

Taking these steps ensures your assets remain under your control — and not in the hands of hackers.