Money is no longer what it used to be. From gold coins to printed bills, humanity’s idea of value has evolved over centuries. Now, a purely digital invention is taking center stage. This is the story of bitcoin — how a single piece of code launched a revolution that continues to ripple across economies, cultures, and personal lives.

🕵️ The Mysterious Origins

In late 2008, amid a devastating global financial crisis, someone named Satoshi Nakamoto sent an academic paper to a small mailing list. It outlined a vision for electronic cash that didn’t rely on trust in banks. A few months later, in January 2009, the first bitcoin block was mined.

To this day, no one knows who Nakamoto really is. The mystery only adds to the allure — proving that an idea, rather than a corporation, could change how the world thinks about money.

💎 Why Bitcoin Is Unique

Most things online can be duplicated endlessly. A song, an email, a meme — all can be copied at zero cost. That doesn’t work for money. If you could simply copy dollars, the economy would collapse.

This is the magic behind bitcoin. Through the blockchain, it guarantees that a digital coin can’t be spent twice. Every transaction gets permanently recorded. No single person or company can change the ledger.

⚙️ How It Actually Works

The blockchain is like a giant shared spreadsheet stored on thousands of computers. When someone sends funds, the network checks that they really own it. Miners — powerful computers racing against each other — verify transactions by solving complex puzzles. The winner adds a block to the chain and gets rewarded.

This process ensures the system stays fair, transparent, and doesn’t rely on any single authority.

🪙 Scarcity and the “Digital Gold” Narrative

Unlike traditional currencies that central banks print by the billions, there will only ever be 21 million bitcoin. As more people adopt it, the supply stays fixed. This is why so many investors see it as “digital gold” — scarce, durable, and resistant to inflation.

Additionally, the network cuts mining rewards roughly every four years in events known as “halvings.” These moments often lead to renewed interest, price speculation, and debates on what this asset might become.

🌍 Impact on Real Lives

💸 The Pizza That Became a Fortune

In 2010, a Florida programmer famously paid 10,000 BTC for two pizzas. At today’s value, that would be hundreds of millions of dollars — a humorous reminder of how perceptions of worth evolve.

🏦 Beyond Jokes: Life or Death Money

In Venezuela, hyperinflation has destroyed entire family savings. Residents turned to bitcoin to protect what little they had left. In Nigeria, young entrepreneurs bypass harsh currency restrictions by accepting crypto payments. Meanwhile, Ukrainian charities have used it to receive donations during war, sidestepping slow bank processes.

🔥 Bitcoin vs. Failing Currencies

In places where banks can freeze accounts overnight or governments print money until it’s worthless, this decentralized asset offers something radical: control. People in Lebanon have used it to escape capital controls. Turks worried about lira devaluation quietly build up small crypto balances.

It’s not just about speculation. For many, owning even a tiny amount of bitcoin means having financial power that no local authority can seize or debase.

🏛 Regulations and Global Tension

Governments worldwide are grappling with how to handle this phenomenon. Some embrace it. El Salvador adopted bitcoin as legal tender. Others try heavy regulation or outright bans.

Central banks are even building their own digital currencies to keep up. The irony? The success of bitcoin forced them to innovate. Whether this leads to healthy competition or attempts to suppress alternatives remains to be seen.

🚀 Getting Started Safely

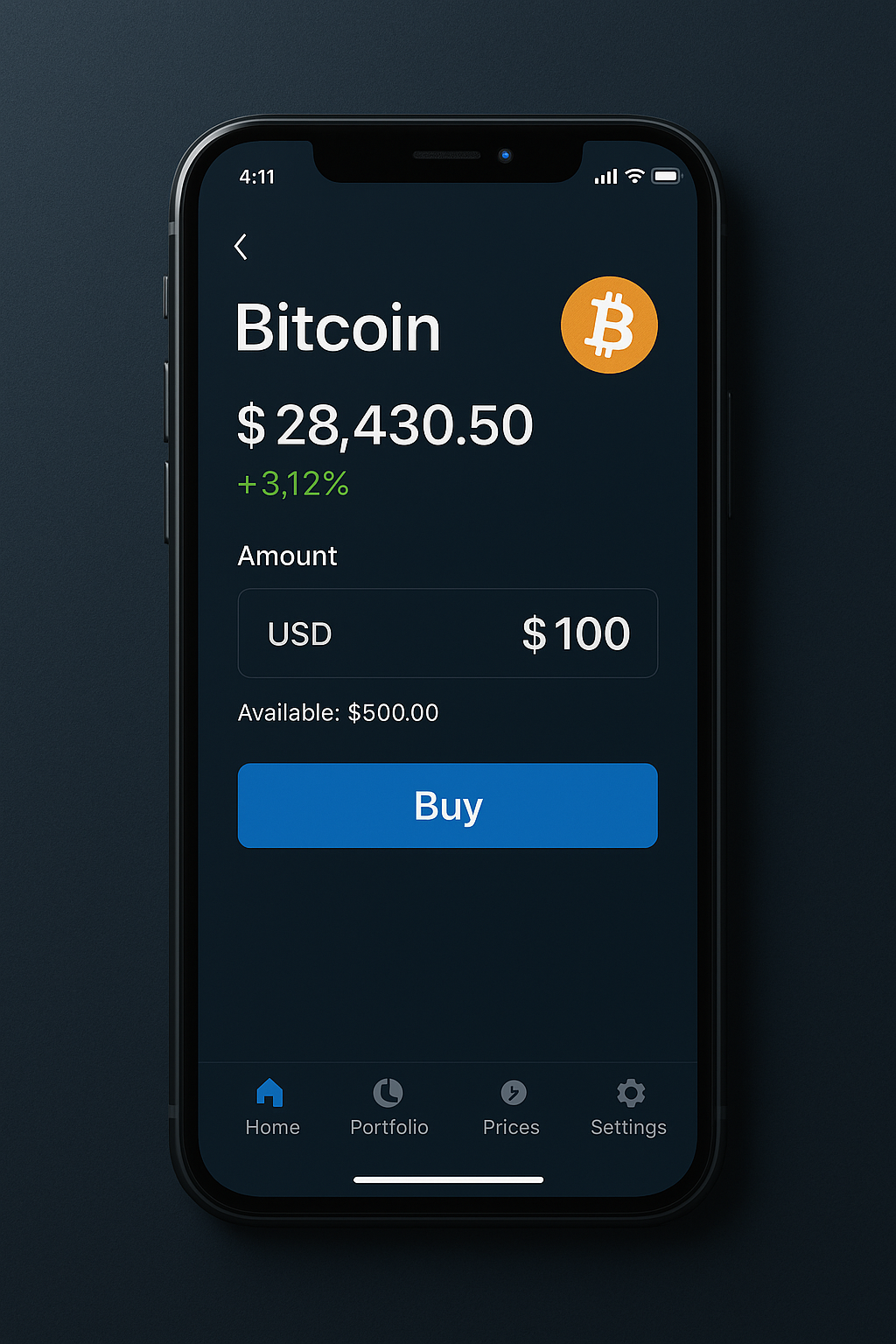

Buying your first slice of this new economy is easier than ever. Platforms like Binance or Coinbase let users purchase bitcoin with simple bank transfers or cards.

✅ Start small to learn the ropes.

✅ Enable two-factor authentication on every account.

✅ Understand the fees — exchanges charge for both trading and withdrawing.

🔐 Security: Protecting Your Private Keys

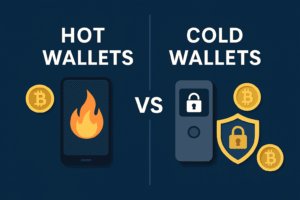

When you own bitcoin, you control it with private keys. Lose them, and your funds vanish forever. Unlike a bank, there’s no customer support to retrieve lost access.

For larger sums, experts recommend using cold storage — hardware wallets that stay offline. Keep backup phrases on paper, not in cloud services vulnerable to hackers.

🌌 Where Does Bitcoin Go From Here?

No one knows if it will one day replace major currencies or simply exist alongside them. It might stabilize and become a reliable store of value, or it could remain a speculative asset.

One thing is certain: bitcoin has already reshaped global conversations about trust, inflation, and who gets to decide what counts as money.

❓ FAQs for Beginners

🔹 Do I need to buy a whole coin?

Not at all. You can start with fractions, even $10 worth. Each bitcoin splits into 100 million tiny pieces called satoshis.

🔹 Is it really secure?

The blockchain itself is nearly unbreakable. The biggest threats come from human mistakes: sharing keys, using bad passwords, or falling for phishing.

🔹 How do taxes work?

In most countries, selling crypto for profit is a taxable event. Check local laws and consider speaking with an accountant.

📝 Final Thoughts

This experiment started by a shadowy figure with a simple nine-page paper. Now, bitcoin is on the lips of presidents, bankers, and teenagers alike.

Whether it becomes the backbone of future economies or just a powerful alternative, one thing is clear: ignoring it is no longer an option. If you’re curious, dive in with care. Start small, prioritize security, and stay informed. The financial world is changing — and this decentralized innovation sits at its core.

🔗 Explore More on Adam Tech Blog

Curious to deepen your crypto knowledge? Check out some of our other popular posts:

These articles break down essential tools and strategies to help you navigate the evolving world of digital finance.

🔗 Affiliate Disclosure

Some links on this page are referral links. If you sign up or make a purchase through them, we may earn a small commission — at no extra cost to you. Thanks for supporting Adam Tech Guide!

Pingback: 🚀 Hot Wallets vs. Cold Wallets: The Ultimate Guide to Keeping Your Crypto Safe - Adam Tech Guide