If you’ve ever read a headline like “Startup X Raises $50 Million to Disrupt Industry Y,” you’ve seen venture capital in action. But beyond the flashy funding announcements, what does venture capital really mean for startups? Why do so many founders chase it — and is it always the smartest move?

In this in-depth guide from Adam Tech Guide, we’ll break down:

✅ Why so many startups turn to venture capital

✅ The advantages (and serious trade-offs)

✅ Who VC actually makes sense for

✅ And how you can decide if it’s right for your own business

🏦 What is Venture Capital?

At its simplest, venture capital (VC) is money provided by investors (called venture capitalists) in exchange for a slice of ownership in your company.

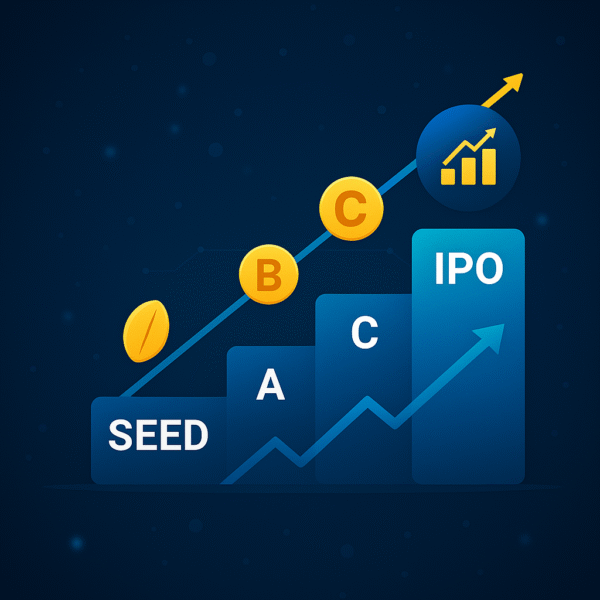

Unlike a traditional bank loan, you don’t repay VCs with interest — instead, they hope your business grows rapidly and eventually goes public (IPO) or gets acquired, so their shares become worth a fortune.

VC funding typically comes in rounds (Seed, Series A, B, C…) as your startup hits milestones.

🚀 Why Startups Seek Venture Capital

Most startups turn to VC for one simple reason: speed.

- Building a new product from scratch costs money.

- Hiring the best engineers costs money.

- Marketing and grabbing early market share? Even more money.

Without outside funding, many businesses would grow slowly, losing out to faster, well-funded competitors.

But VC isn’t just about writing checks. It also brings:

✅ Validation: Being backed by a top VC signals credibility, attracting customers, hires, and press.

✅ Connections: Investors open doors to partnerships, suppliers, or even future acquirers.

✅ Expert guidance: Many VCs are seasoned operators who’ve helped dozens of startups scale.

🌟 The Perks of Venture Capital Funding

💰 1. Big checks, big moves

VCs write larger checks than angel investors or friends-and-family. That lets you:

- Scale quickly, often by hiring aggressively.

- Enter multiple markets simultaneously.

- Invest heavily in product before worrying about immediate profits.

This is exactly why many startups in industries like SaaS, biotech, and fintech chase venture capital — building advanced tech before they ever charge customers.

🤝 2. Powerful networks

Top VC firms (like Sequoia, Andreessen Horowitz, Accel) have vast portfolios and connections. Being in their ecosystem can help:

- Land meetings with key partners.

- Recruit seasoned executives.

- Secure favorable terms with suppliers.

🚀 3. Fuel for blitzscaling

Many markets reward the first mover or the startup that captures dominant mindshare. With millions in funding, you can:

- Outspend rivals in ads.

- Offer better pricing.

- Lock up strategic customers or contracts.

That’s why Uber, Airbnb, and Stripe all aggressively raised venture capital — to win big before competitors could catch up.

⚠️ The Hidden Costs & Pressures of VC

It’s easy to look at VC as “free money.” But it comes with serious strings attached.

🔥 1. Loss of control

Raising VC means giving up a chunk of your company. Over multiple rounds, founders often drop to owning 20-30% of their startup.

VCs typically take board seats and can veto major decisions. Want to expand slowly or pivot? Your investors might disagree.

📈 2. Pressure for explosive growth

VCs need large returns to offset their many failed bets. That means they push startups to grow at breakneck speed — sometimes at the expense of long-term stability.

This is why you hear stories of companies spending millions monthly to scale, hoping revenue catches up before the runway runs out.

🛠 3. Exit expectations

VCs don’t want small, stable businesses. They want unicorns (startups valued over $1 billion) that either go public or get acquired. If your dream is to run a modest, profitable company forever, VC might not align.

🎯 Who Should Consider Venture Capital?

VC isn’t for every startup. Here’s when it might make sense:

✅ You’re in a winner-takes-most market, where scaling fast is crucial.

✅ Your business needs upfront investment (e.g. hardware, biotech).

✅ You’re comfortable aiming for a big exit — even if it means owning a smaller slice.

On the flip side, if you’d rather keep control, grow sustainably, and eventually live off profits, bootstrapping might be the better path. (Check out our guide on Startup Funding 101: Bootstrapping vs. Venture Capital for a full comparison.)

🚀 Real Startup Examples

🏗 Stripe: Scaling payment rails globally

Stripe raised billions in VC to integrate payments into thousands of businesses worldwide. Their funding let them tackle complex international regulations and expand faster than smaller rivals.

🏠 Airbnb: Winning trust through blitzscale

Airbnb used VC to rapidly grow teams, fight legal battles, and offer insurance & guarantees that built customer trust.

🚕 Uber: A textbook VC play

Uber burned through enormous sums to dominate ride-hailing markets before local competitors could gain traction — a move only possible with aggressive VC backing.

❓ FAQs

🔹 How much equity do startups usually give up to VCs?

It varies, but typical Seed rounds might cost you 10-20%, while by Series C, founders might only own 30% or less combined.

🔹 Do all startups need venture capital?

Not at all. Many successful companies bootstrap or take small angel investments instead. VC is just one path.

🔹 Can I start bootstrapped and raise VC later?

Yes! Many founders grow slowly at first, then raise funding at better valuations once they have traction.

🔗 Other Helpful Reads on Adam Tech Guide

If you found this deep dive useful, you’ll love these other guides on our site:

- 📝 Startup Funding 101: Bootstrapping vs. Venture Capital

- 📈 Best Tools for Lean Startups: From Asana to FreshBooks

- 💳 Why Many Founders Use Revolut & Wise for Global Payments

- 🪙 Crypto.com for Startups: All-in-One Guide to Crypto Spending & Rewards

📝 Conclusion

It’s easy to be dazzled by headlines about startups raising hundreds of millions in venture capital. But behind those checks are complex trade-offs: less control, enormous growth expectations, and the reality that most VC-backed startups either fail or get forced into exits.

For many founders, VC is the best (or only) way to build world-changing companies. For others, keeping it small, sustainable, and entirely theirs is more rewarding.

Whatever path you choose, make sure it aligns with your goals, your risk tolerance, and the life you truly want to live.