⭐️ Introduction: Why KuCoin Deserves a Fresh Look in 2025

If you’ve been navigating the crypto world for a while, you’ve likely heard of KuCoin. Known as “The People’s Exchange,” KuCoin launched in 2017 and quickly became a go-to platform for altcoin trading.

But the question today is:

Is KuCoin still worth using in 2025?

With increasing competition from Binance, Coinbase Advanced, Bybit, and rising decentralized exchanges, KuCoin must continuously evolve. Spoiler alert — it has.

In this review, we’ll explore:

- Key features that set KuCoin apart

- Its vast altcoin support

- Trading tools and UI

- Fee structure

- Security upgrades

- Pros, cons, and alternatives

- Who should (and shouldn’t) use it in 2025

Let’s dive deep.

💼 Company Background: Who Runs KuCoin?

KuCoin is operated by Mica Forest PTE Ltd., headquartered in Seychelles (previously in Hong Kong). While it’s not registered in the US, it offers global service to over 30 million users in 200+ countries.

KuCoin is not a regulated exchange in most jurisdictions. However, it has invested in compliance and risk tools to reduce regulatory friction — especially as governments tighten crypto policies worldwide.

📊 User Interface & Experience: Clean, Fast, and Feature-Rich

The KuCoin dashboard is clean, dark-themed by default, and fast to load across desktop and mobile. New traders can use “Spot Lite” mode, while advanced users have access to full features like:

- Pro-level trading terminal with charts powered by TradingView

- Customizable indicators

- Depth and order flow analysis

- Live order book and market trade history

- Fast order execution (under 10ms for spot)

The mobile app (iOS & Android) is one of the highest-rated crypto apps, offering spot, margin, bot, and futures trading — all from a sleek UI.

💡 TIP: For beginners, KuCoin’s onboarding tutorial is interactive and helpful — covering how to deposit, swap tokens, and use trading bots.

💱 Supported Cryptocurrencies: Altcoin Paradise

KuCoin is famous for its deep altcoin listings. As of July 2025, it offers over 850+ cryptocurrencies and 1,400+ trading pairs.

Popular listings include:

- Blue chips: BTC, ETH, BNB, ADA, SOL

- Stablecoins: USDT, USDC, DAI

- DeFi: SUSHI, AAVE, UNI

- Layer 2s: OP, ARB, zkSync

- Memecoins: DOGE, SHIB, PEPE, WIF

- AI tokens: FET, AGIX, RNDR

- Launchpad tokens: KuCoin Labs’ newest picks

This wide range makes KuCoin a prime destination for altcoin hunters and early-stage investors.

⚙️ Core Features That Make KuCoin Stand Out

1. Spot & Margin Trading

- Spot trading pairs with deep liquidity

- Margin trading with up to 10x leverage

- Stop-limit, market, and post-only order types

2. KuCoin Futures

- USDT-M and COIN-M contracts

- Up to 125x leverage

- Advanced charting, hedge modes, and auto-deleveraging

🧠 Did you know? KuCoin has its own Risk Monitoring Engine that flags unusual volatility and auto-protects users from forced liquidations during flash crashes.

3. Trading Bots

One of KuCoin’s biggest innovations — you can deploy smart trading bots directly from your dashboard:

- Grid Bot (range trading)

- DCA Bot (dollar cost averaging)

- Smart Rebalance (portfolio automation)

- Futures Grid (for leveraged trading)

No coding needed.

4. Earn with KuCoin

- Flexible & fixed staking (ETH 2.0, USDT, LUNA)

- Dual Investment Products

- KuCoin Pool (PoW mining)

- Shark Fin structured products with principal protection

5. KuCard (NEW in 2025)

A crypto debit card linked to your KuCoin wallet — allows spending USDT or BTC globally with cashback rewards.

🛡 Security: Can You Trust KuCoin in 2025?

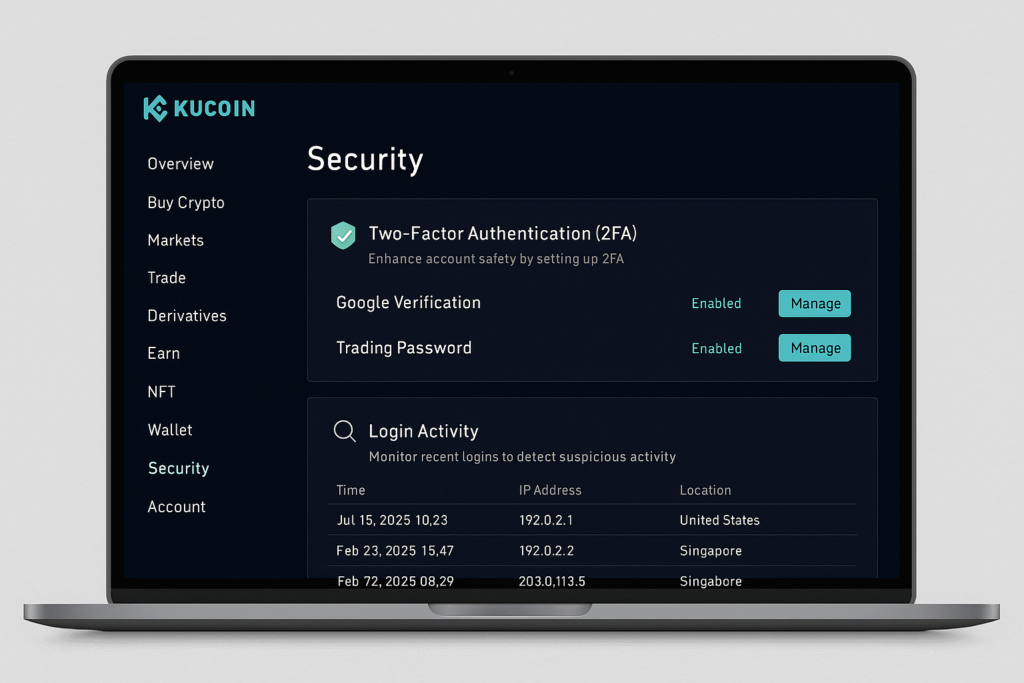

✅ What KuCoin Does Well:

- Cold wallet storage for 95% of user funds

- Multi-factor authentication

- Anti-phishing codes

- Real-time IP & device monitoring

- Partnership with Onchain Custodian for custody

🛑 Where KuCoin Needs Improvement:

- Past security incident in 2020: ~$280M was stolen but fully recovered

- Not licensed in the US or EU — users must self-custody or proceed with caution

- No proof-of-reserves system yet as of July 2025

💬 User Sentiment: According to Reddit’s r/cryptocurrency and Trustpilot (3.8/5 rating), users like the low fees and coin support but complain about delayed support responses.

💸 KuCoin Fees (2025)

KuCoin follows a maker-taker fee model:

|

Volume (30d) |

Maker Fee |

Taker Fee |

|

$0 – $50K |

0.1% |

0.1% |

|

$50K – $100K |

0.09% |

0.1% |

|

$100K – $1M |

0.08% |

0.09% |

Ways to reduce fees:

- Pay with KCS (KuCoin Token) — 20% discount

- Hold more KCS for additional rebates

- Use referral codes and promos

⚠️ Note: There are withdrawal fees, and they vary by coin. ETH might cost $3–$5 in fees during peak times.

🌍 Global Access, But Not for Everyone

KuCoin serves users without KYC for up to 1 BTC daily withdrawal. However, for full access (trading bots, higher limits), Level 1 KYC is required:

- Government-issued ID

- Face scan

- Proof of residence

❗️ US citizens can register but not KYC, which violates KuCoin’s terms. You risk frozen withdrawals.

🧠 Who Should Use KuCoin in 2025?

|

✅ Best For |

❌ Not Ideal For |

|

Altcoin traders |

US-based users |

|

Bot traders & grid fans |

Beginners needing fast fiat ramp |

|

Margin/Futures traders |

Compliance-conscious investors |

|

Yield seekers |

Users wanting licensed exchanges |

📈 Pros & Cons

Pros:

✅ Massive altcoin support

✅ Advanced tools and bots

✅ Low trading fees

✅ Strong mobile app

✅ Passive earning opportunities

Cons:

❌ Not licensed in major countries

❌ Risk of future regulation restrictions

❌ No phone support

🔁 Alternatives to Consider

|

Exchange |

Strength |

|

Binance |

Larger liquidity, more fiat ramps |

|

Coinbase Advanced |

Fully regulated, intuitive |

|

Bybit |

Better derivatives engine |

|

MEXC |

Lower withdrawal fees |

But none beat KuCoin’s altcoin diversity and bots in 2025.

🔐 Final Thoughts: Is KuCoin Worth It in 2025?

KuCoin remains a powerful platform for altcoin enthusiasts, active traders, and crypto earners — especially those outside the US and EU regulatory boundaries.

It’s not for everyone, especially those needing full regulatory clarity, but for millions of users, KuCoin provides:

- Access to tokens before they list elsewhere

- Flexibility with bots, staking, and derivatives

- Simplicity in UI yet power under the hood

✅ If you’re willing to self-manage custody and don’t require full KYC, KuCoin is still one of the best crypto exchanges in 2025.

Affiliate Disclosure: This post contains affiliate links. If you sign up using these links, we may earn a commission at no additional cost to you. This helps us keep Adam Tech Guide running and free.

🔗 Explore More from Adam Tech Guide

If you found this KuCoin review helpful, you’ll love these in-depth guides and comparisons from our blog:

🪙 Crypto Tools & Platforms

-

Top 5 Crypto crypto platforms Compared: The Ultimate Guide to Finding Your Perfect PlatformBinance vs. KuCoin: Which Is Better in 2025?

A side-by-side breakdown of the crypto giants, focusing on fees, features, and safety. -

Coinbase: The Ultimate Crypto Platform

A beginner-friendly guide to the Coinbase platform. -

Binance: The Ultimate Crypto Platform

A beginner-friendly guide to the Binance platform.

🔐 Security & Privacy

-

Top 10 Cybersecurity Best Practices Everyone Should Follow

From strong passwords to avoiding phishing — essential reading for any online investor. -

Complete Guide to Two-Factor Authentication (2FA)

Why 2FA matters, and how to enable it on exchanges like KuCoin, Binance, and Coinbase.